UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

VeriSign, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| | |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | |

(1) | Title of each class of securities to which transaction applies: |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| | |

(2) | Aggregate number of securities to which transaction applies: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Date Filed:

| |

(4) | Proposed maximum aggregate value of transaction: |

NOTICE OF

| |

¨ | Fee paid previously with preliminary materials. |

| |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

VeriSign, Inc.

12061 Bluemont Way

Reston, Virginia 20190

April 11, 201913, 2021

To Our Stockholders:

You are cordially invited to attend the 20192021 Annual Meeting of Stockholders (the “Annual Meeting”) of VeriSign, Inc. (“we,” “our,” “us” or the “Company”) to be held at our corporate offices located at 12061 Bluemont Way, Reston, Virginia 20190 on Thursday, May 23, 2019,27, 2021, at 10:00 a.m., Eastern Time. In light of continuing concerns related to COVID-19, we have made the decision to again conduct the Annual Meeting exclusively by remote communication via live webcast (i.e., a virtual-only meeting). No physical Annual Meeting will be held this year. A virtual Annual Meeting provides access for all stockholders while safeguarding the health and safety of our stockholders, directors, officers, employees, and other stakeholders.

The matters expected to be acted upon at the Annual Meeting are described in detail inon the following Notice of 2019 Annual Meeting of Stockholders and Proxy Statement.pages.

We are using a U.S. Securities and Exchange Commission rule that allows us to furnish our proxy materials over the internet. As a result, we are mailing to our stockholders a Notice of InternetRegarding the Availability of Proxy Materials instead of a paper copy of our 2018 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2018 (the “Annual Report”), and the following Proxy Statement,. together with our 2020 Annual Report. The Notice of InternetRegarding the Availability of Proxy Materials contains instructions on how to access those documents over the internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how each stockholder caninternet or receive a paper copy of our proxy materials, including the following Notice of 2019 Annual Meeting of Stockholders and Proxy Statement, our Annual Report and a proxy card.those documents. We believe that this process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

It is important that you use this opportunity to take part in the affairs of the Company by voting on the business to come before the Annual Meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE AS DESCRIBED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS AND UNDER “INTERNET AND TELEPHONE VOTING” IN THE PROXY STATEMENT, OR ALTERNATIVELY, IF RECEIVING PAPER COPIES OF PROXY MATERIALS, COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM BY MAIL USING THE ENCLOSED ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE ANNUAL MEETING.Whether or not you plan to attend the virtual-only Annual Meeting, please vote electronically via the internet or by telephone as described on the Notice Regarding the Availability of Proxy Materials and under “Information About the Meeting—Internet and Telephone Voting” of the following Proxy Statement, or alternatively, if you have received paper copies of our proxy materials, please complete, date, sign and promptly return the accompanying proxy card or voting instruction form by mail using the enclosed envelope so that your shares may be represented at the Annual Meeting. Returning or completing the proxy card does not deprive you of your right to attend the virtual-only Annual Meeting and to vote your shares in person.shares.

We look forward to seeingThank you atfor your continued support of the Annual Meeting.

|

|

|

| Sincerely, |

|

| /s/ D. James Bidzos |

| D. James Bidzos |

|

Chairman of the Board of Directors and Executive Chairman President and Chief Executive Officer |

VERISIGN, INC.

12061 Bluemont Way

Reston, Virginia 20190

Notice of 20192021 Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Date and Time | | | The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) will be held for the following purposes: |

| | |

| May 27, 2021 (Thursday) 10:00 a.m. (Eastern Time) | | | | | | | | |

| | | PROPOSALS | | BOARD VOTE RECOMMENDATION | | FOR FURTHER DETAILS |

| | | 1 | Election of Eight Directors Named in the Proxy Statement | |  FOR FOReach director nominee | | |

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of VeriSign, Inc. (the “Company”) will be held at the Company’s corporate offices located at 12061 Bluemont Way, Reston, Virginia 20190 on Thursday, May 23, 2019, at 10:00 a.m., Eastern Time. The Annual Meeting is being held for the following purposes:

1. To elect the seven directors of the Company named in the Proxy Statement, each to serve until the next annual meeting, or until a successor has been elected and qualified or until the director’s earlier resignation or removal.

2. To approve, on a non-binding, advisory basis, the Company’s executive compensation.

3. To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2019.

4. To vote on a stockholder proposal, if properly presented at the Annual Meeting, requesting that the Board adopt a policy that requires the Chair of the Board to be an independent member of the Board.

5. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 28, 2019 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

| Location | | | | |

| The Annual Meeting will be held exclusively by remote communication via live webcast at www.meetingcenter.io/266478282. No physical Annual Meeting will be held this year. | | | 2 | Advisory Vote to Approve Executive Compensation | |  FOR FOR | | |

| | 3 | Ratification of Selection of KPMG LLP as Independent Registered Public Accounting Firm for 2021 | |  FOR FOR | | |

| | | |

| | 4 | Stockholder Proposal to Permit Stockholder Action by Written Consent | |  AGAINST AGAINST | | |

| |

Stockholders will also transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. If you hold your shares as of the record date as a stockholder of record, you or your proxyholder may participate, vote, submit questions during the meeting, and examine a list of the stockholders of record entitled to vote at the Annual Meeting by accessing www.meetingcenter.io/266478282 and entering the 15-digit control number on your Proxy Card or Notice Regarding the Availability of Proxy Materials and entering VRSN2021 as the meeting password. If you hold your shares as of the record date through an intermediary, such as a bank or broker, you may access the virtual-only Annual Meeting through one of the options described in “Information About the Meeting” in the accompanying Proxy Statement. Reston, Virginia April 13, 2021 By Order of the Board of Directors, |

|

/s/ Thomas C. Indelicarto |

Thomas C. Indelicarto Secretary |

Secretary | Who Can Vote | | |

| Only stockholders of record at the close of business on April 1, 2021, which is the record date, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. | | |

| | |

| | |

| | | | |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE AS DESCRIBED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS AND UNDER “INTERNET AND TELEPHONE VOTING” IN THE PROXY STATEMENT, OR ALTERNATIVELY, IF RECEIVING PAPER COPIES OF PROXY MATERIALS, COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM BY MAIL USING THE ENCLOSED ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE ANNUAL MEETING.Notice of 2021 Annual Meeting of Stockholders

How to Vote

ImportantWhether or not you plan to attend the virtual-only Annual Meeting, please vote electronically via the internet or by telephone as described on the Notice Regarding the Availability of Proxy Materials forand under “Information About the Meeting—Internet and Telephone Voting” in the proxy statement, or alternatively, if you have received paper copies of proxy materials, complete, date, sign and promptly return the accompanying proxy card or voting instruction form by mail using the enclosed envelope so that your shares may be represented at the Annual Meeting of Stockholders to be Held on May 23, 2019: The Proxy Statement and Annual Report are available at www.edocumentview.com/vrsn.

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | |

| Internet | Telephone | Mail | By Accessing the

Virtual-Only Meeting |

Vising the website listed on your proxy card | Call the telephone number on your proxy card | Sign, date and return your proxy card in the enclosed envelope | Attend and vote at the virtual-only Annual Meeting |

| | | | | | | | |

| |

| Page |

| Important Notice Regarding the Availability of Proxy StatementMaterials for the 2019 Annual Meeting of Stockholders to be Held on May 27, 2021: The 2021 Proxy Statement, together with the 2020 Annual Report, are available at www.edocumentview.com/vrsn. | |

| | |

A Notice Regarding the Availability of Proxy Materials or the Proxy Statement and related proxy materials were first sent or made available to stockholders on April 13, 2021.

Table of Contents

| | | | | | | | |

| |

| |

| |

| |

Responding to COVID-19 and Committing to Responsible Corporate GovernanceCitizenship | |

| |

| | |

| |

|

|

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

VERISIGN, INC.

12061 Bluemont Way

Reston, Virginia 20190In this Proxy Statement, the terms “we,” “our,” “us,” “Verisign” or the “Company” refer to VeriSign, Inc.

Verisign’s Mission, Values, and Strategic Framework

Our mission and values form Verisign’s DNA, the principles under which we perform our primary responsibility: helping to enable the security, stability, and resiliency of key internet infrastructure and services. With this DNA, we develop a strategy framework that guides our day-to-day operations. Every year, we develop our corporate goals to support this strategy, which are organized around three strategic framework principles: Protect Unconditionally, Grow Responsibly, and Manage Continuously.

Verisign’s Mission

Verisign enables the world to connect online with reliability and confidence, anytime, anywhere.

Verisign’s Values

| | | | | | | | |

We are stewards of the internet and our Company A significant portion of the world’s economy relies on the internet infrastructure we help to manage and operate. As stewards of the internet infrastructure, what we do and how we do it are critical to the secure and reliable operation of the global internet upon which billions of people worldwide depend, every second of every day. As stewards of our Company, our actions and decisions create value for our shareholders and we earn the trust they have placed in us. We are passionate about technology and continuous improvement We embrace new technologies and new ideas and the potential they promise, enabling us to build, sustain and improve on the internet’s infrastructure. We challenge past assumptions and do not accept that what works today will work tomorrow. | | We respect others and exhibit integrity in our actions The internet has made the world a smaller place, and how an individual or a company acts is becoming more transparent. We believe that acting with integrity and respect invites the same treatment in return. We also believe it’s the right thing to do. We demonstrate respect and integrity in our interactions with all of our stakeholders - customers, shareholders, business partners, internet users and fellow colleagues. We take responsibility for our actions and hold ourselves to a higher standard We understand that the role we play in supporting the global internet is a privilege and with that privilege comes great responsibility. We appreciate that our decisions and actions have consequences far beyond our own Company, and, therefore, we hold ourselves to a higher standard in all we do. |

Verisign’s Strategic Framework

| | | | | | | | |

We protect unconditionally and expand our existing business. | We grow responsibly as we pursue identified new business opportunities. | We manage continuously by operating our business effectively for our shareholders, customers and employees. |

2020 Highlights

2020 Business Highlights

| | | | | | | | | | | |

| | | |

$1.27 billion Revenue  3% increase compared 3% increase comparedto 2019 | $824.2 million Operating Income  2% increase compared 2% increase comparedto 2019 | 165.2 million .com and .net Domain Name Registrations in Domain Name Base at End of 2020  4% increase from 4% increase fromDecember 31, 2019 | 42.4 million New Domain Name Registrations Processed for .com and .net in 2020 compared to 40.3 million in 2019 |

| | | |

PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERSResponding to COVID-19 and Committing to Responsible Corporate Citizenship

2020 was a year that brought unexpected and serious challenges to businesses worldwide. In a year during which online connection became critical, Verisign’s continued focus on our mission – enabling the world to connect online with reliability and confidence, anytime, anywhere – allowed us to continue to provide businesses and individuals with the transparent and reliable navigation services they depend on.

Prioritizing the Safety and Well-Being of Employees

Throughout the pandemic, the safety and well-being of our employees has remained a key focus. At the outset of the pandemic, we established a task force to monitor the pandemic and to actively protect our employees. Beginning in March 2020, we transitioned approximately 95% of our employees to a work-from-home status. To protect the health of our employees who work on site, we have implemented rigorous cleaning and safety protocols for our facilities. We adjusted employee leave and other policies with the intention of ensuring that our workforce had the flexibility it needed to manage personal challenges arising from the pandemic. We enhanced mental health resources available to our employees, and unique individual requirements are supported to the greatest degree possible. In addition, we have taken steps to ensure that our employees have the equipment and resources that they require to work remotely. Finally, to reinforce our connection with our employees, we have significantly increased leadership updates and management outreach.

Executing on Business Continuity Plans

We have continued to execute on business continuity plans for the uninterrupted continuation of our services, while most of our employees continue to work remotely. Verisign has maintained 100 percent operational accuracy and stability of the .com and .net domain name system for more than 23 years. This unparalleled achievement is due not only to the unwavering dedication of our team but, in 2020, also to our companywide commitments to mission and to employee safety first.

Supporting Small Businesses

In response to the immediate uncertainty of the early weeks of the pandemic, we had frozen registry prices for all our top-level domains, including .com and .net, and waived wholesale registry restore fees.

Committing to Responsible Corporate Citizenship

Verisign is committed to responsible corporate citizenship. This commitment is reflected in our adoption of Diversity, Equity and Inclusion and Environmental, Social and Governance objectives, and the work of Verisign Cares, our philanthropic and charitable program, which saw a significant expansion in 2020. Having provided considerable immediate support to community organizations, first responders and small businesses at the onset of the pandemic, we then began exploring opportunities to help those whose jobs were displaced by, or perhaps lost to, COVID-19’s economic impact. In December, Verisign Cares entered into its first partnership under this new initiative, with Virginia Ready, a newly established nonprofit organization in our home state of Virginia which helps motivated Virginians to reskill for in-demand jobs in high-growth sectors such as our own. Verisign Cares also made significant contributions to the Equal Justice Initiative during the summer’s eruption of social unrest, and to food banks in regions where we have business operations to help with immediate COVID-related hardship. Our direct charitable contributions in 2020 totaled $3.5 million.

April 11, 2019

Voting Roadmap

The accompanying proxy is solicited on behalf of theour Board of Directors (the “Board”) of VeriSign, Inc. (“we,” “our,” “us,” “Verisign” or the “Company”) for use at the 20192021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at our corporate offices located at 12061 Bluemont Way, Reston, Virginia 20190 on Thursday, May 23, 201927, 2021 at 10:00 a.m., Eastern Time. Only holdersIn light of recordcontinuing concerns related to COVID-19, we have made the decision to again conduct the Annual Meeting exclusively by remote communication via live webcast (i.e., a virtual-only meeting). No physical Annual Meeting will be held this year. A virtual Annual Meeting provides access for all stockholders while safeguarding the health and safety of our common stock atstockholders, directors, officers, employees, and other stakeholders.

This summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all of the close of business on March 28, 2019, which isinformation that you should consider, and we encourage you to read the record date, will be entitled to vote at the Annual Meeting. Thisentire Proxy Statement and related proxy materials were first made availablebefore voting.

Election of Directors

| | | | | | | | | | | |

| FOR | The Board recommends a vote FOR each director nominee. | |

Director Nominees

The following provides summary information about each director nominee.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | COMMITTEE MEMBERSHIP |

| NAME | | AGE | | DIRECTOR

SINCE | | AUDIT | | COMPENSATION | | CORPORATE

GOVERNANCE

AND

NOMINATING | | CYBERSECURITY |

| D. James Bidzos | | 66 | | 1995 | | | | | | | | M |

Yehuda Ari Buchalter IND | | 49 | | 2019 | | | | | | M | | M |

Kathleen A. Cote IND | | 72 | | 2008 | | M | | | | C | | |

Thomas F. Frist III IND | | 53 | | 2015 | | | | M | | M | | |

Jamie S. Gorelick IND | | 70 | | 2015 | | | | M | | M | | |

Roger H. Moore IND | | 79 | | 2002 | | M | | | | M | | C |

Louis A. Simpson IND | | 84 | | 2005 | | | | C | | M | | |

Timothy Tomlinson IND | | 71 | | 2007 | | C | | M | | M | | M |

C – Chairperson M – Member IND – Independent

Corporate Governance Highlights

| | | | | | | | |

| Board Composition | | •7 out of 8 directors are independent. •2 out of 8 directors are women. |

| Annual Election of Directors | | •All directors are elected annually. |

| Majority Voting Standard | | •To be elected in uncontested elections, each nominee for director must receive a majority of the votes cast. |

| Lead Independent Director | | •We have a lead independent director with robust responsibilities. |

| Board Committees | | •We have an Audit Committee, Corporate Governance and Nominating Committee and Compensation Committee, each of which is composed entirely of independent directors. •In February 2020, the Board established a Cybersecurity Committee, which began meeting formally in April 2020, to assist the Board with its oversight of the Company’s cybersecurity program and risks. |

| Stockholder Rights | | •Stockholders have proxy access rights. •Stockholders owning as few as 10% of outstanding common stock may call a special meeting of stockholders. |

| Single Voting Class | | •Our common stock is the only class of voting shares outstanding. |

| One Share, One Vote | | •Each share of our common stock is entitled to one vote. |

| Annual Board Leadership Evaluation | | •The Board evaluates the Board leadership structure annually. |

Annual Self-Evaluations | | •The Board conducts an annual self-evaluation to determine whether it and its committees are functioning effectively. |

| No “Poison Pill” | | •We do not have a stockholder rights plan, or “poison pill,” in place. |

Annual Auditor Ratification | | •Stockholders have the opportunity to ratify the Audit Committee’s selection of our independent registered public accounting firm annually. |

| Stock Retention Policy | | •Directors and executives are subject to a stock retention policy. |

Advisory Vote to stockholders on or about April 11, 2019. Our 2018 Annual Report to Stockholders, which includes our Annual Report on Form 10-K forApprove Executive Compensation

| | | | | | | | | | | |

| FOR | The Board recommends a vote FOR this proposal. | |

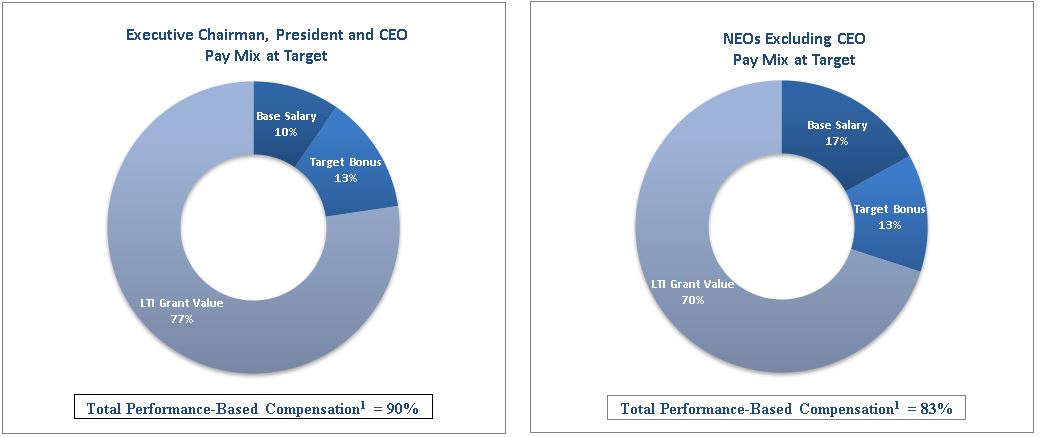

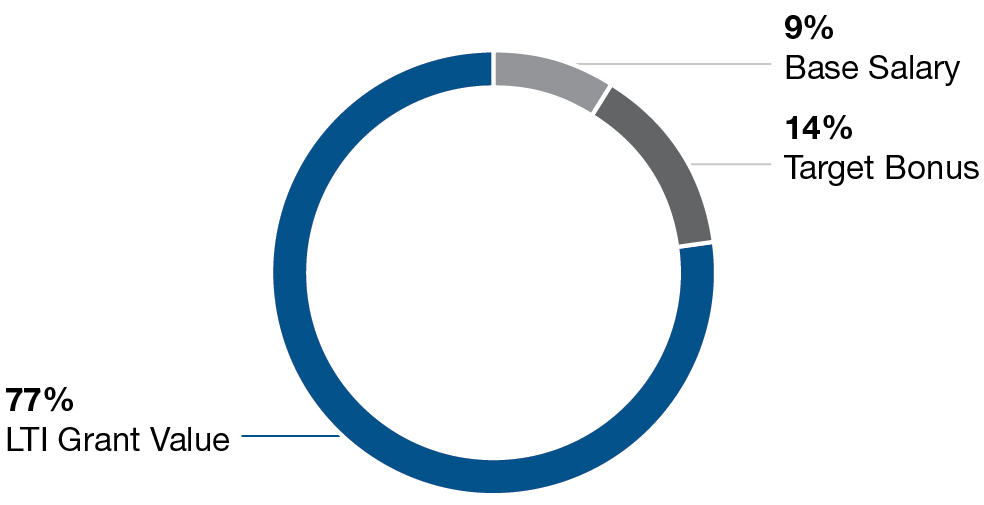

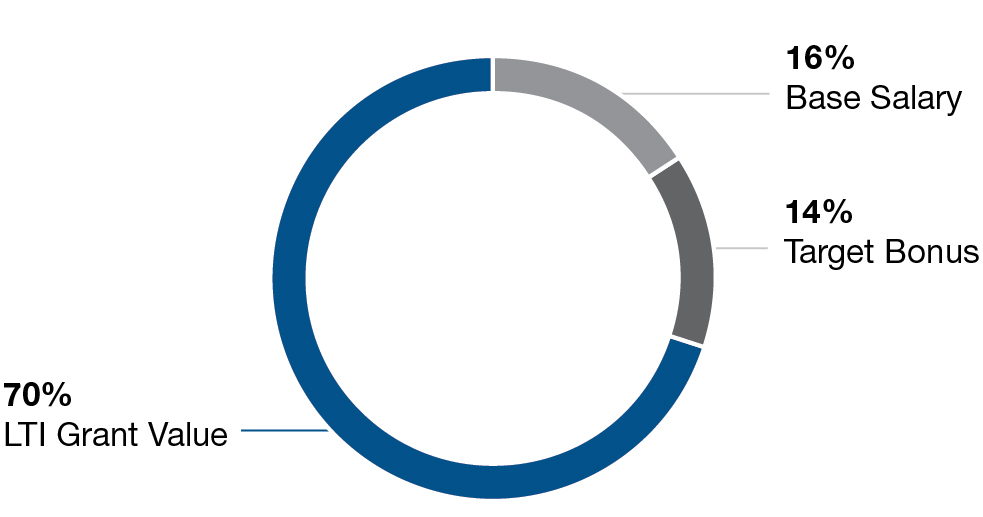

Compensation Framework

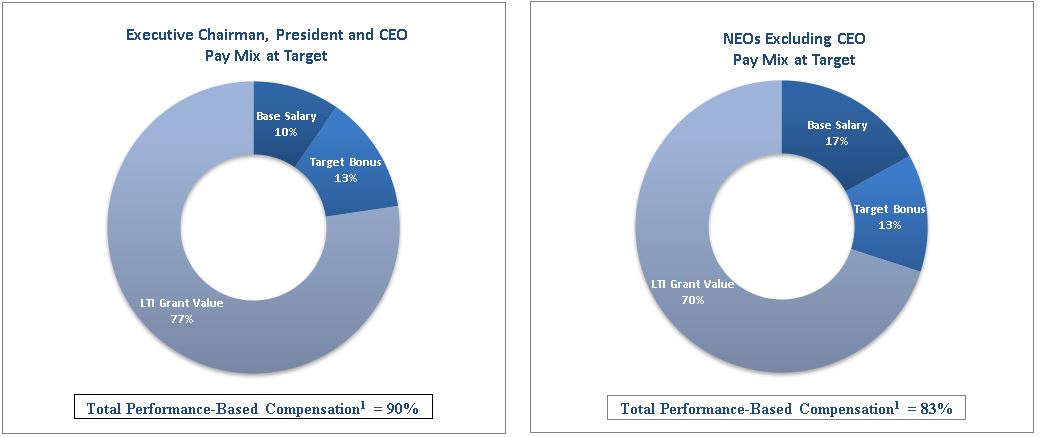

The chart below shows the year ended December 31, 2018 (the “Annual Report”), is enclosed with this Proxy Statement for stockholders receiving a paper copy of proxy materials. The Annual Report and this Proxy Statement can both be accessed on the Investor Relations sectionthree main elements of our websiteexecutive compensation program (including the percentage that each element comprised in our CEO’s 2020 pay mix at https://investor.verisign.comtarget and our other NEOs’ 2020 average pay mix at target), or at www.edocumentview.com/vrsnour objectives for each element of compensation, and the factors we use to determine compensation amounts.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ELEMENT | | OBJECTIVE | | FACTORS | | MEASURES |

| CEO | | Other NEOs (Average) | | | | | | |

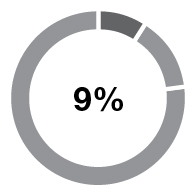

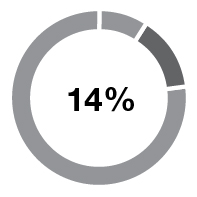

Base Salary (% of Pay Mix at Target) | | Provide a guaranteed level of annual income in order to attract and retain our executive talent. Increases are not automatic or guaranteed. | | •Job responsibilities and scope •Experience •Individual contributions •Internal pay equity | | |

| | | | | | |

| | | | | | | |

| CEO |

| Other NEOs (Average) | | | | | | |

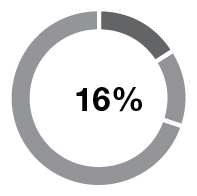

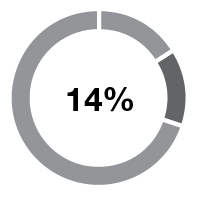

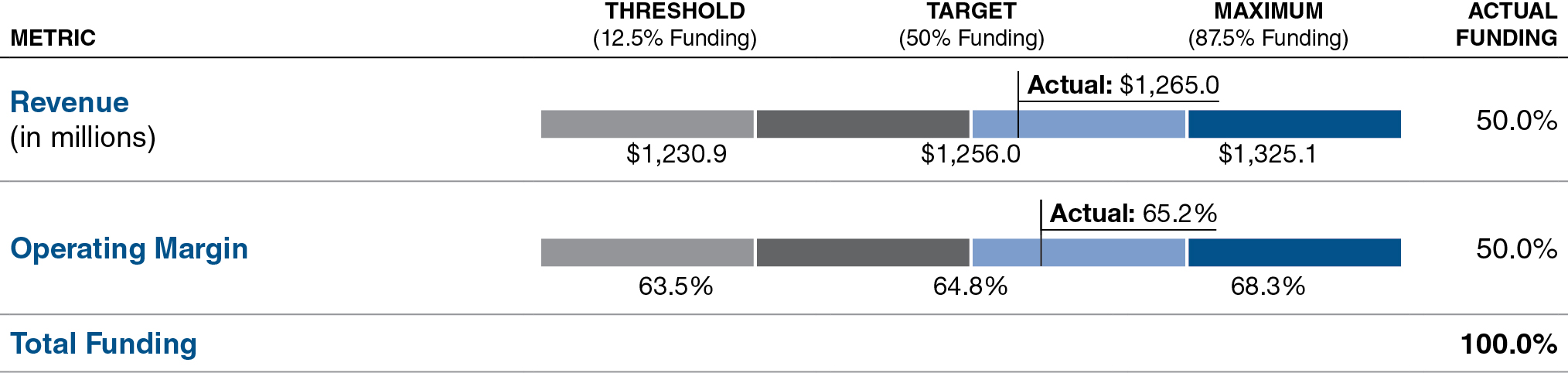

Annual Incentive Bonus (% of Pay Mix at Target) | | Provide a reward for achieving individual goals and the Company’s financial and strategic goals. | | •Company performance •Individual performance | | •Revenue •Operating margin |

| | | | | |

| | | | | | | |

| CEO |

| Other NEOs (Average) | | | | | | |

Long-Term Incentive Compensation (% of Pay Mix at Target) | | Provide an award that both serves a retention purpose and incentivizes executives to manage the Company from the perspective of a stockholder. | | •Importance of the executive to Company performance •Individual contributions •Future potential of the executive •Value of executive’s vested and unvested outstanding equity awards | | •Compound annual growth rate (CAGR) of operating income per share •Total Shareholder Return (TSR) |

| | | | | |

| | | | | | | | |

All proxies received will be voted in accordance with the instructions as submitted. Unless contrary instructions are specified, if the applicable proxy is submitted (and not revoked) prior to the Annual Meeting, the sharesTable of Verisign common stock represented by the proxy will be voted: (1) ContentsFOR the election of each of the seven director candidates nominated by the Board (Proposal No. 1); (2) FOR the non-binding, advisory resolution to approve Verisign’sVoting Roadmap

Executive Compensation Highlights

Our executive compensation (Proposal No. 2); (3) FOR program is designed to attract and retain the ratificationexecutive talent we need to maintain our high performance standards and grow our business for the future. Our philosophy is to provide a mix of the selectioncompensation that motivates our executives to achieve our short and long-term performance goals, which in turn will create value for our stockholders. We made no significant changes to our overall approach to executive compensation for 2020.

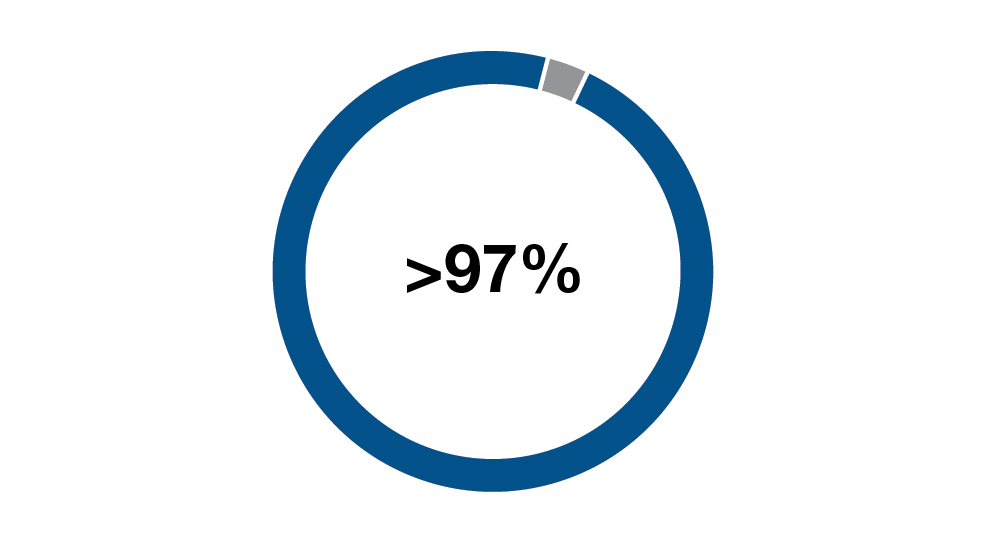

| | | | | | | | |

| Pay for Performance Alignment | | •For the CEO, 91% of targeted total compensation is performance-based. |

| | •For other NEOs, 84% of targeted total compensation on average is performance-based. |

| Compensation Governance Practices and Policies | | •Annual Benchmarking of Executive Compensation |

| | •Independent Compensation Consultant |

| | •Annual Say-on-Pay Vote |

| | •Stock Ownership Requirements |

| | •Clawback Policy |

| | •Forfeiture Provisions |

| | •Annual Compensation Risk Assessment |

| Responsible Pay Practices | | •No Employment Contracts |

| | •No Single Trigger Benefits Upon a Change-in-Control |

| | •No Tax Gross-Ups Upon a Change-in-Control |

| | •No Special Pension or Retirement Plans |

| | •No Significant Perquisites |

Ratification of Selection of KPMG LLP as our independent registered public accounting firmIndependent Registered Public Accounting Firm for 2021

| | | | | | | | | | | |

| FOR | The Board recommends a vote FOR this proposal. | |

Principal Accountant Fees and Services

The following table presents fees billed for professional services rendered by KPMG LLP for the year endingaudit of our annual consolidated financial statements for the years ended December 31, 2020 and December 31, 2019, (Proposal No. 3); (4) AGAINST the stockholder proposal, if properly presented at the Annual Meeting, requesting that the Board adopt a policy that requires the Chairand fees billed for other services provided by KPMG LLP, in each of the Board to be an independent memberlast two completed years.

| | | | | | | | | | | | | | |

| | 2020 FEES | | 2019 FEES |

Audit fees(1) | | $1,665,095 | | $1,630,734 |

| Audit-related fees | | – | | – |

Tax fees(2) | | 13,966 | | 23,894 |

| All other fees | | – | | – |

| Total Fees | | $1,679,061 | | $1,654,628 |

(1)Audit fees consist of fees for the integrated audit of the Board (Proposal No. 4); and (5)annual financial statements included in accordance withour Annual Reports on Form 10-K, the best judgmentreview of the named proxiesinterim financial statements included in our Quarterly Reports on anyForm 10-Q and other matters properly brought before the Annual Meeting.professional services provided in connection with statutory and regulatory filings or engagements for those years.

Voting Rights(2)Tax fees consist principally of technical tax advice.

At the close of business on the record date, we had 119,408,403 shares of common stock outstanding and entitledStockholder Proposal to vote. Holders of our common stock are entitled to one vote for each share held as of the record date.Permit Stockholder Action by Written Consents

Quorum, Effect of Abstentions and Broker Non-Votes, Vote Required to Approve the Proposals | | | | | | | | | | | |

| AGAINST | The Board recommends a vote AGAINST this stockholder proposal. | |

A majority of the shares of our common stock outstanding and entitled to vote must be present in person or represented by proxy at the Annual Meeting in order to have a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum. A broker non-vote occurs when a bank, broker or other stockholder of record holding shares for a beneficial owner has not received voting instructions from the beneficial owner and does not vote on a particular proposal because that record holder does not have discretionary voting power with respect to that “non-routine” proposal. Each of the election of directors (Proposal No. 1), the non-binding, advisory vote to approve executive compensation (Proposal No. 2), and the stockholder proposal, if properly presented at the Annual Meeting, requesting that the Board adopt a policy that requires the Chair of the Board to be an independent member of the Board (Proposal No. 4) is a “non-routine” proposal and so shares for which record holders do not receive voting instructions will not be voted on such matters. The ratification of the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2019 (Proposal No. 3) is a “routine” proposal and so shares for which record holders do not receive voting instructions may be voted on such matter by record holders.

If a quorum is present at the Annual Meeting, to be elected, a nominee for director must receive a majority of the votes cast (the number of shares voted “for” that nominee must exceed the number of votes cast “against” that nominee). Under this voting standard, abstentions and broker non-votes will not affect the voting outcome. Stockholders may not cumulate votes in the election of directors.

If a nominee who currently serves as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” Under our Corporate Governance Principles, each director that is not re-elected by the stockholders must tender his or her resignation to the Board. In that situation, our Corporate Governance and Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. Within 90 days from the date that the election results are certified, the Board will act on the Corporate Governance and Nominating Committee’s recommendation and publicly disclose its decision and the rationale for that decision.

If a quorum is present at the Annual Meeting, approvalElection of the proposals for:

the non-binding, advisory resolution to approve Verisign’s executive compensation (Proposal No. 2);

the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2019 (Proposal No. 3); and

the stockholder proposal, if properly presented at the Annual Meeting, requesting that the Board adopt a policy that requires the Chair of the Board to be an independent member of the Board (Proposal No. 4)

requires, in each case, the affirmative vote of a majority of the shares of our common stock present or represented by proxy and entitled to vote on the matter. Under this voting standard, abstentions will have the effect of votes cast against the proposal, and broker non-votes will not affect the voting outcome.Directors

The inspectorBoard consists of elections appointed for the Annual Meeting will separately tabulate for and against votes, abstentions and broker non-votes.

Adjournment of Annual Meeting

In the event that a quorum shall fail to attend the Annual Meeting, either in person or represented by proxy, the Chairman may adjourn the Annual Meeting, or alternatively, the holders of a majority of the shares of our common stock entitled to vote who are present in person or by represented by proxy may adjourn the Annual Meeting. Any such adjournment proposed by a stockholder or person named as a proxy would require the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting.

Expenses of Soliciting Proxies

Verisign will pay the expenses of soliciting proxies to be voted at the Annual Meeting. Verisign intends to retain Morrow Sodali LLC for various services related to the solicitation of proxies, which we anticipate will cost approximately $32,500, plus reimbursement of expenses. Following the original mailing of the Notice of Internet Availability of Proxy Materials and paper copies of proxy materials, we and/or our agents may also solicit proxies by mail, telephone, electronic transmission, including email, or in person. Following the original mailing of the Notice of Internet Availability of Proxy Materials and paper copies of the proxy materials, we will request that brokers, custodians, nominees and other record holders of our shares forward copies of the proxy materials to persons for whom they hold shares and request authority for the exercise of proxies. In such cases, we will reimburse the record holders for their reasonable expenses if they ask us to do so.

Revocability of Proxies

A stockholder who holds shares of record as a registered stockholder may revoke any proxy that is not irrevocable by attending the Annual Meeting and voting in person or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company. If your shares are held through a bank or brokerage firm, you must follow the instructions provided by that institution to change or revoke your voting instructions.

Internet and Telephone Voting

If you hold shares of record as a registered stockholder, you can simplify your voting process and save the Company expense by voting your shares by telephone at 1-800-652-VOTE (8683) or on the internet at www.envisionreports.com/VRSN24 hours a day, seven days a week. Telephone and internet voting are available through 12:00 a.m. Eastern Time on the day of the Annual Meeting. More information regarding internet voting is given on the Notice of Internet Availability of Proxy Materials. If you hold shares through a bank or brokerage firm, the bank or brokerage firm will provide you with separate instructions on a form you will receive from them. Many such firms make telephone or internet voting available, but the specific processes available will depend on those firms’ individual arrangements.

Householding

A number of brokerage firms have instituted a procedure called “householding,” which has been approved by the Securities and Exchange Commission (the “SEC”). Under this procedure, the firm delivers only one copy of the Notice of Internet Availability of Proxy Materials or paper copies of the Annual Report and this Proxy Statement, as the case may be, to multiple stockholders who share the same address and have the same last name, unless it has received contrary instructions from an affected stockholder. If your shares are held in “street name” and you would like to receive only one copy of these materials (instead of separate copies) in the future, please contact your bank, broker or other holder of record to request information about householding. If you would like to receive an individual copy of the Notice of Internet Availability of Proxy Materials or paper copies of the Annual Report and this Proxy Statement, as the case may be, now or in the future, we will promptly deliver these materials to you upon request to VeriSign, Inc., 12061 Bluemont Way, Reston, Virginia 20190, Attention: Secretary or (703) 948-3200.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

There are currently seveneight directors. The terms of the current directors who are identified below, expire upon the election and qualification of the directors to be elected at the Annual Meeting. The Board has nominated each of the current directors, D. James Bidzos, Yehuda Ari Buchalter, Kathleen A. Cote, Thomas F. Frist III, Jamie S. Gorelick, Roger H. Moore, Louis A. Simpson, and Timothy Tomlinson, each of whom is a current director, for election at the Annual Meeting to serve until our 20202022 Annual Meeting of Stockholders and until their respective successors have been elected and qualified. Proxies cannot be voted for more than seveneight persons, which is the number of nominees.

Unless otherwise directed, the persons named as proxies on the proxy card intend to vote all proxies FOR the election of the Board’s nominees, as listed below, each of whom has consented to serve as a director if elected. In addition, if a proxy card is properly executed and returned but no direction is made, the persons named as proxies on the proxy card intend to vote all proxies FOR the election of the nominees listed below.Board’s nominees. If, at the time of the Annual Meeting, any of the nominees is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Board, unless the Board chooses to reduce its own size. The Board has no reason to believe that any of the nominees will be unable or will decline to serve if elected.

Director Nominees

Set forth below is certain information relating to our director nominees, including details on each director nominee’s specific experience, qualifications, attributes or skills that led the Board to conclude that the person should be nominated for election as a director for another term.

|

| | | | | | | |

Name | | Age | | Position |

Nominees for election as directors

for a term expiring at the 2020 annual meeting: | FOR | | | |

D. James Bidzos | | 64 | | ChairmanThe Board recommends a vote FOR the election of each of the Board, Executive Chairman, President and Chief Executive Officer |

Kathleen A. Cote(1)(2) | | 70 | | Director |

Thomas F. Frist III(2)(3) | | 51 | | Director |

Jamie S. Gorelick(2)(3) | | 68 | | Director |

Roger H. Moore(1)(2) | | 77 | | Director |

Louis A. Simpson(2)(3) | | 82 | | Lead Independent Director |

Timothy Tomlinson(1)(2)(3) | | 69 | | Directorforegoing director nominees. |

| |

(1) | Member of the Audit Committee. |

| |

(2) | Member of the Corporate Governance and Nominating Committee. |

| |

(3) | Member of the Compensation Committee. |

D. James Bidzos has served as Executive Chairman since August 2009Independence, Skills, Experience and President and Chief Executive Officer since August 2011. He served as Executive Chairman and Chief Executive Officer on an interim basis from June 2008 to August 2009 and served as President from June 2008 to January 2009. He served as Chairman of the Board since August 2007 and from April 1995 to December 2001. He served as Vice Chairman of the Board from December 2001 to August 2007. Mr. Bidzos served as a director of VeriSign Japan K.K. (“Verisign Japan”) from March 2008 to August 2010 and served as Representative Director of Verisign Japan from March 2008 to September 2008. Mr. Bidzos served as Vice Chairman of RSA Security Inc., an internet identity and access management solution provider, from March 1999 to May 2002, and Executive Vice President from July 1996 to February 1999. Prior thereto, he served as President and Chief Executive Officer of RSA Data Security, Inc. from 1986 to February 1999.Diversity

Mr. Bidzos is a business executive with significant expertise in the technology that is central to the Company’s business. Mr. Bidzos is an internet and security industry pioneer who understands the strategic technology trends in markets that are important to the Company. Mr. Bidzos was a founder of the Company and has been either Chairman or Vice Chairman of the Company’s Board since the Company’s founding in April 1995, providing him with valuable insight and institutional knowledge of the Company’s history and development. Mr. Bidzos has prior experience on our Compensation Committee and our Corporate Governance and Nominating Committee and as a member of several other public-company boards. Mr. Bidzos’ years of board-level experience contribute important knowledge and insight to the Board. Additionally, Mr. Bidzos’ executive-level experience includes many years as a Chief Executive Officer, providing him with a perspective that the Board values. Mr. Bidzos also has international business experience from his service as a director of Verisign Japan.

Kathleen A. Cote has served as a director since February 2008. From May 2001 to June 2003, Ms. Cote served as Chief Executive Officer of Worldport Communications, Inc., a provider of internet managed services. From September 1998 to May 2001, she served as Founder and President of Seagrass Partners, a consulting firm specializing in providing strategic planning, business,

operational and management support for startup and mid-sized technology companies. From November 1996 to January 1998, she served as President and Chief Executive Officer of Computervision Corporation, a supplier of desktop and enterprise, client server and web-based product development and data management software and services. Ms. Cote is currently a director of Western Digital Corporation and, within the past five years, served as a director of GT Advanced Technologies Inc. Ms. Cote holds an Honorary Doctorate from the University of Massachusetts, an M.B.A. degree from Babson College, and a B.A. degree from the University of Massachusetts, Amherst.

Ms. Cote is a business executive with significant expertise overseeing global companies in technology and operations in the areas of systems integration, networks, hardware and software, including web-based applications and internet services. Ms. Cote’s expertise in technology and operations is directly relevant to the Company’s businesses. Ms. Cote’s expertise as a business executive also includes sales and marketing, product development, strategic planning and international experience, which contributes important expertise to the Board in those areas of business administration. Ms. Cote’s financial and accounting skills qualify her as an audit committee financial expert. In addition to Ms. Cote’s tenure as a director of the Company, Ms. Cote has served on several other boards of directors, including service on the audit and corporate governance committees of those boards, providing her with valuable board-level experience. Ms. Cote’s executive-level experience includes experience as a Chief Executive Officer, providing her with a perspective that the Board values.

Thomas F. Frist III has served as a director since December 2015. Mr. Frist is the Founder and Managing Principal of Frist Capital, LLC, an investment firm based in Nashville, Tennessee he founded in 2002 that makes long-term equity investments in public and private companies. Prior to that he was the managing member of FS Partners II, LLC and he worked in principal investments at Rainwater, Inc. from 1992 to 1995. Mr. Frist holds a B.A. degree from Princeton University and an M.B.A. degree from Harvard Business School.

Mr. Frist’s significant directorship experience provides valuable expertise and perspective to the Board. Since 2008, he has served on the Board of Directors of HCA Holdings, Inc. (now known as HCA Healthcare, Inc.) and serves as chair of its Finance and Investments Committee. Mr. Frist also served as a director for Science Applications International Corporation from 2013 to 2017. In addition to the significant experience as a board member, Mr. Frist provides valuable experience in areas of business administration, finance and operations, which the Board values.

Jamie S. Gorelick has served as a director since January 2015. Ms. Gorelick has been a partner at Wilmer Cutler Pickering Hale and Dorr LLP, an international law firm, since 2003. She served as Deputy Attorney General of the United States from 1994 to 1997 and as General Counsel of the Department of Defense from 1993 to 1994. She has been a director of Amazon.com, Inc. since 2012 and serves as Chair of its Nominating and Corporate Governance Committee. She previously served as a director of United Technologies Corporation and of Schlumberger Limited. She holds B.A. and J.D. degrees from Harvard University.

Ms. Gorelick is an experienced attorney with significant expertise in legal, policy and corporate matters. Ms. Gorelick’s regulatory and policy experience is directly relevant to the Company’s business. She is well-versed in critical infrastructure and national security issues and brings a valuable skill-set and wealth of government experience to the Board. Ms. Gorelick has served on several other corporate boards, a compensation committee and a nominating and corporate governance committee, and served on numerous government boards and commissions. Ms. Gorelick’s experience in both the public and private sectors, combined with her experience in the corporate boardroom, provides her valuable board experience, and she offers a perspective the Board values.

Roger H. Moore has served as a director since February 2002. From December 2007 to May 2009, he served as a consultant assisting Verisign in the divestiture of its Communications Services business. From June 2007 through November 2007, Mr. Moore served as interim Chief Executive Officer and President of Arbinet-thexchange, Inc., a provider of online trading services. He was President and Chief Executive Officer of Illuminet Holdings, Inc. from December 1995 until December 2001 when it was acquired by Verisign. Mr. Moore is currently a director of Consolidated Communications Holdings, Inc. and, within the past five years, served as a director of Western Digital Corporation. Mr. Moore holds a B.S. degree in General Science from Virginia Polytechnic Institute and State University.

Mr. Moore is a business executive with significant expertise in general management, sales, technology and strategic planning in the telecommunications industry. Mr. Moore’s expertise contributes operational knowledge of important inputs to the Company’s businesses and provides valuable experience in areas of business administration. Mr. Moore also has significant experience, both as a senior executive and as a board member, in joint venture and mergers and acquisition transactions, which is experience that is valuable to the Board. Mr. Moore’s financial and accounting skills qualify him as an audit committee financial expert. Mr. Moore also serves on several other boards of directors, including service on the audit, compensation and corporate governance committees of certain of those boards, providing him with valuable board-level experience. In addition to the several years of business management experience mentioned above, Mr. Moore has international business experience from his time as President of Nortel Japan and as President of AT&T Canada.

Louis A. Simpson has served as a director since May 2005. Mr. Simpson has served as Chairman of SQ Advisors, LLC, an investment firm since January 2011. From May 1993 to December 2010, he served as President and Chief Executive Officer, Capital Operations, of GEICO Corporation, a passenger auto insurer. Mr. Simpson previously served as Vice Chairman of the Board of

GEICO from 1985 to 1993. Mr. Simpson holds a B.A. degree from Ohio Wesleyan University and an M.A. degree in Economics from Princeton University.

Mr. Simpson is a business executive with significant expertise in insurance, finance and private investment. Mr. Simpson’s expertise contributes all around business acumen, skills in strategic planning and finance, along with knowledge important to mergers and acquisitions activity. Throughout his career, Mr. Simpson has served on the boards of directors of more than fifteen publicly traded companies, providing him with extensive and valuable board-level experience. Mr. Simpson’s board-level experience also includes previous audit committee, finance committee, nominating and corporate governance committee and compensation committee experience on certain of those public-company boards. Mr. Simpson is a recognized expert in corporate governance matters, having lectured and presented numerous times on corporate governance topics at seminars and continuing education courses. As indicated above, Mr. Simpson’s career includes executive-level experience as a Chief Executive Officer, providing him with a perspective that the Board values.

Timothy Tomlinson is a long-tenured member of the Board, having served from the Company’s founding in 1995 until 2002, and again since his reappointment in November 2007. From May 2011 through December 2013, Mr. Tomlinson was a corporate lawyer employed as General Counsel of Portola Minerals Company, a producer and seller of limestone products. From May 2007 through May 2011, Mr. Tomlinson was employed as Of Counsel by the law firm Greenberg Traurig, LLP. Mr. Tomlinson was the founder and a named partner of Tomlinson Zisko LLP and practiced with this Silicon Valley law firm from 1983 until its acquisition by Greenberg Traurig, LLP in May 2007. He served as managing partner of Tomlinson Zisko LLP for multiple terms. Mr. Tomlinson holds a B.A. degree in Economics, a Ph.D. degree in History, an M.B.A. and a J.D. degree from Stanford University.

Mr. Tomlinson has significant expertise in corporate matters including finance and mergers and acquisitions and has represented clients in the technology industry for more than thirty years. Mr. Tomlinson’s long-term service on our Board has provided him with valuable insight and institutional knowledge of the Company’s history and development. Mr. Tomlinson’s financial and accounting skills qualify him as an audit committee financial expert. He has extensive experience in corporate governance, both as a lawyer advising clients, and through serving on our Audit, Compensation and Corporate Governance and Nominating Committees, as well as the audit, compensation, and governance committees of other companies.

Compensation of Directors

This section provides information regarding the compensation policies for non-employee directors and amounts earned and securities awarded to these directors in 2018. Mr. Bidzos is the Company’s Executive Chairman, President and Chief Executive Officer. As an employee of the Company, Mr. Bidzos does not participate in the compensation program for non-employee directors, and he is compensated as an executive officer of the Company. Mr. Bidzos’ compensation is described in “Executive Compensation” elsewhere in this Proxy Statement.

Non-Employee Director Retainer Fees and Equity Compensation Information

On July 24, 2018, the Compensation Committee met to consider the cash and equity-based compensation to be paid to non-employee directors. The Compensation Committee reviewed competitive market data prepared by Frederic W. Cook & Co., Inc. (“FW Cook”), its independent compensation consultant, for the same peer group it used to benchmark executive compensation, as well as compensation practices for boards of other companies. For information about the peer group, see “Executive Compensation—Compensation Discussion and Analysis.” The Compensation Committee sets director compensation levels at or near the market median relative to directors at companies in the peer group in order to ensure directors are paid competitively for their time commitment and responsibilities. Providing a competitive compensation package is important because it enables us to attract and retain highly qualified directors who are critical to our long-term success. Following the July 2018 review, including consideration of the recommendations made by FW Cook, the Compensation Committee determined that it was in the best interests of Verisign and its stockholders to make no changes to the amount of the directors’ annual cash retainer fees (as described in the table below) or to the annual equity award grant to each director of $250,000 (made solely in the form of restricted stock units (“RSUs”), which vest immediately upon grant). Historically, new directors are granted an equity award equal to the pro rata amount of such annual equity award, the amount of which is determined based on the date of such new director’s appointment or election to the Board. Directors are subject to the Company’s Stock Retention Policy as described in “Executive Compensation—Compensation Discussion and Analysis.”

Directors received annual cash retainer fees for 2018 as follows:

|

| | |

| Annual retainer for non-employee directors | $ | 40,000 |

| Additional annual retainer for Non-Executive Chairman of the Board(1) | $ | 100,000 |

| Additional annual retainer for Lead Independent Director | $ | 25,000 |

| Additional annual retainer for Audit Committee members | $ | 25,000 |

| Additional annual retainer for Compensation Committee members | $ | 20,000 |

| Additional annual retainer for Corporate Governance and Nominating Committee members | $ | 10,000 |

| Additional annual retainer for Audit Committee Chairperson | $ | 15,000 |

| Additional annual retainer for Compensation Committee Chairperson | $ | 10,000 |

| Additional annual retainer for Corporate Governance and Nominating Committee Chairperson | $ | 5,000 |

| Additional annual retainer for Safety and Security Council Liaison | $ | 15,000 |

| |

(1) | The position of “Non-Executive Chairman of the Board” was not held during 2018, and as such no annual retainer fees were paid during this period. |

Non-employee directors are reimbursed for their expenses incurred in attending meetings.

Our Amended and Restated VeriSign, Inc. 2006 Equity Incentive Plan limits the compensation (including equity and cash awards) paid to any non-employee director in any year to an aggregate dollar value of $600,000, with an exception to allow for up to two times such limit for grants made in the first year of service or first year designated as chairman or lead independent director.

Non-Employee Director Compensation Table for 2018

The following table sets forth a summary of compensation information for our non-employee directors for 2018.

DIRECTOR COMPENSATION FOR 2018

|

| | | | | | |

| Non-Employee Director Name | | Fees Earned or

Paid in Cash

($)(1) | | Stock

Awards

($)(2) | | Total ($) |

| Kathleen A. Cote | | 80,000 | | 249,956 | | 329,956 |

| Thomas F. Frist III(3) | | 53,804 | | 249,956 | | 303,760 |

| Jamie S. Gorelick | | 70,000 | | 249,956 | | 319,956 |

| Roger H. Moore | | 90,000 | | 249,956 | | 339,956 |

| Louis A. Simpson | | 105,000 | | 249,956 | | 354,956 |

| Timothy Tomlinson | | 110,000 | | 249,956 | | 359,956 |

| |

(1) | Amounts shown represent retainer fees earned by each director. |

| |

(2) | Stock Awards consist solely of RSUs which vest immediately upon grant. Amounts shown represent the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for the applicable awards granted in 2018. The grant date fair value of each Stock Award granted to each non-employee director on July 24, 2018 was $249,956 (1,684 RSUs at $148.43 per share closing price on the grant date). |

| |

(3) | Mr. Frist was appointed to the Compensation Committee on October 23, 2018. |

The Board Recommends a Vote “FOR” the Election of Each of the Director Nominees.

CORPORATE GOVERNANCE

Independence of Directors

As required under The Nasdaq Stock Market’s listing standards, a majority of the members of our Board must qualify as “independent directors,” as determined by the Board. The Board and the Corporate Governance and Nominating Committee consult with our legal counsel to confirm that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of The Nasdaq Stock Market.

Consistent with these considerations, after review of all relevant transactions and relationships between each director, or any of his or her family members, and Verisign, our executive officers or our independent registered public accounting firm, our Board affirmatively determined on February 12, 201916, 2021 that sixseven out of seventhe eight members of our Board are independent directors. Our independent directors are:are Dr. Buchalter, Ms. Cote, Mr. Frist, Ms. Gorelick, Mr. Moore, Mr. Simpson, and Mr. Tomlinson. Each director who serves onmember of the Audit Committee, the Compensation Committee and/orand the Corporate Governance and Nominating Committee is an independent director. Each member of the Cybersecurity Committee other than Mr. Bidzos is an independent director. Mr. Bidzos serves as Executive Chairman President and Chief Executive Officer and thus is not considered independent.an independent director.

Proposal 1—Election of Directors

Skills, Experience and Diversity

The chart below shows the range of skills and experience represented on the Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | BIDZOS | | BUCHALTER | | COTE | | FRIST | | GORELICK | | MOORE | | SIMPSON | | TOMLINSON |

| Accounting, Corporate Finance and Capital Management | | | | | | | | | | | | | | | | |

| Corporate Governance and Ethics | | | | | | | | | | | | | | | | |

| Executive Experience | | | | | | | | | | | | | | | | |

| International/Global Experience | | | | | | | | | | | | | | | | |

| Government and Public Policy | | | | | | | | | | | | | | | | |

| Legal and Regulatory | | | | | | | | | | | | | | | | |

| Other Public Company Board Experience | | | | | | | | | | | | | | | | |

| Risk Management | | | | | | | | | | | | | | | | |

| Strategic Planning and Oversight | | | | | | | | | | | | | | | | |

| Technology and Cybersecurity | | | | | | | | | | | | | | | | |

| | | | | | | | |

BOARD DIVERSITY •2 directors are women. •1 director identifies as LGBTQ+. •With the adoption of the “Rooney Rule” in 2020, the Board is committed to including female and racially/ethnically diverse candidates in the pool in new director searches. |

|

Proposal 1—Election of Directors

Director Nominees

Set forth below is certain information relating to our director nominees, including details on each director nominee’s specific experience, qualifications, attributes or skills that led the Board to conclude that the person should be nominated for election as a director for another term.

| | | | | | | | |

| | |

D. JamesBidzos | |

Age: 66 | | Committees: Cybersecurity |

| | |

Background

Mr. Bidzos has served as Executive Chairman since August 2009 and Chief Executive Officer since August 2011. He served as President from August 2011 to February 2020, Executive Chairman and Chief Executive Officer on an interim basis from June 2008 to August 2009, and President from June 2008 to January 2009. He served as Chairman of the Board since August 2007 and from April 1995 to December 2001. He served as Vice Chairman of the Board from December 2001 to August 2007. Mr. Bidzos served as a director of VeriSign Japan K.K. from March 2008 to August 2010 and served as Representative Director of VeriSign Japan K.K. from March 2008 to September 2008. Mr. Bidzos served as Vice Chairman of RSA Security Inc., an internet identity and access management solution provider, from March 1999 to May 2002, and Executive Vice President from July 1996 to February 1999. Prior to that, he served as President and Chief Executive Officer of RSA Data Security, Inc. from 1986 to February 1999.

Qualifications

Mr. Bidzos is a business executive with significant expertise in the technology that is central to the Company’s business. Mr. Bidzos is an internet and security industry pioneer who understands the strategic technology trends in markets that are important to the Company. Mr. Bidzos was a founder of the Company and has been either Chairman or Vice Chairman of the Company’s Board since the Company’s founding in April 1995, providing him with valuable insight and institutional knowledge of the Company’s history and development. Mr. Bidzos has prior experience on our Compensation Committee and our Corporate Governance and Nominating Committee and as a member of many other public-company boards. Mr. Bidzos’ years of board-level experience contribute important knowledge and insight to the Board. Additionally, Mr. Bidzos’ executive-level experience includes many years as a Chief Executive Officer, providing him with a perspective that the Board values. Mr. Bidzos also has international business experience from his service as a director of VeriSign Japan K.K.

| | | | | | | | |

| | |

Yehuda Ari BuchalterIND | |

Age: 49 | | Committees: Corporate Governance and Nominating, Cybersecurity |

| | |

Background

Dr. Buchalter has served as a director since July 2019. Since May 2017, Dr. Buchalter has served as the Chief Executive Officer of Intersection Holdings, LLC (“Intersection”), a leading smart cities media and technology company. At Intersection, Dr. Buchalter leads the Infosec Leadership Team, which is responsible for overseeing the company’s security and risk management issues, including data security and privacy issues. From July 2008 to January 2017, Dr. Buchalter served as the Chief Operating Officer and then President of MediaMath, a leading programmatic advertising technology platform. From January 2005 to April 2008, Dr. Buchalter was a Senior Partner at the marketing consultancy agency Rosetta, where he led the Digital Media & Technology vertical. Prior to that, Dr. Buchalter was an Associate Principal in McKinsey & Company’s Media & Technology practice and a founding member of their Innovation practice. Dr. Buchalter holds a B.S. in Physics from Stanford University, a Ph.D. in Astronomy from Columbia University, and was a postdoctoral fellow in Theoretical Astrophysics at the California Institute of Technology.

Qualifications

Dr. Buchalter is a business executive with significant experience building and leading technology companies. Dr. Buchalter’s expertise as a business executive includes business administration, sales and marketing, product development, engineering and operations, providing him with a perspective that the Board values.

Proposal 1—Election of Directors

| | | | | | | | |

| | |

Kathleen A. CoteIND | |

Age: 72 | | Committees: Audit, Corporate Governance and Nominating (Chair) |

| | |

Background

Ms. Cote has served as a director since February 2008. From May 2001 to June 2003, Ms. Cote served as Chief Executive Officer of Worldport Communications, Inc., a provider of internet managed services. From September 1998 to May 2001, she served as Founder and President of Seagrass Partners, a consulting firm specializing in providing strategic planning, business, operational and management support for startup and mid-sized technology companies. Prior to that, she served as President and Chief Executive Officer of Computervision Corporation, a supplier of desktop and enterprise, client server and web-based product development and data management software and services. Ms. Cote has served as a director of Western Digital Corporation since January 2001 and currently serves as its Lead Independent Director. Ms. Cote holds an Honorary Doctorate from the University of Massachusetts, an M.B.A. degree from Babson College, and a B.A. degree from the University of Massachusetts, Amherst.

Qualifications

Ms. Cote is a business executive with significant expertise overseeing global companies in technology and operations in the areas of systems integration, networks, hardware and software, including web-based applications and internet services. Ms. Cote’s expertise in technology and operations is directly relevant to the Company’s businesses. Ms. Cote’s expertise as a business executive also includes sales and marketing, product development, strategic planning and international experience, which contributes important expertise to the Board in those areas of business administration. Ms. Cote’s financial and accounting skills qualify her as an audit committee financial expert. In addition to Ms. Cote’s tenure as a director of the Company, Ms. Cote has served on several other boards of directors, including service on the audit and corporate governance committees of those boards, providing her with valuable board-level experience. Ms. Cote’s executive-level experience includes experience as a Chief Executive Officer, providing her with a perspective that the Board values.

| | | | | | | | |

| | |

Thomas F. Frist III IND | |

Age: 53 | | Committees: Compensation, Corporate Governance and Nominating |

| | |

Background

Mr. Frist has served as a director since December 2015. Since April 2019, Mr. Frist has served as Chairman of the Board of Directors of HCA Healthcare, Inc. where he has served as a director since 2006. Mr. Frist is the Founder and Managing Principal of Frist Capital, LLC, an investment firm based in Nashville, Tennessee he founded in 2002 that makes long-term equity investments in public and private companies. Prior to that he was the managing member of FS Partners II, LLC and he worked in principal investments at Rainwater, Inc. from 1992 to 1995. Mr. Frist previously served as a director of Science Applications International Corporation from 2013 until 2017. Mr. Frist holds a B.A. degree from Princeton University and an M.B.A. degree from Harvard Business School.

Qualifications

Mr. Frist’s significant directorship experience provides valuable expertise and perspective to the Board. His directorship experience includes having chaired, and served as a member of, various public company board committees. In addition to his significant experience as a public company director, Mr. Frist provides valuable experience in areas of business administration, finance and operations, which the Board values.

Proposal 1—Election of Directors

| | | | | | | | |

| | |

Jamie S. GorelickIND | |

Age:70 | | Committees: Compensation, Corporate Governance and Nominating |

| | |

Background

Ms. Gorelick has served as a director since January 2015. Ms. Gorelick has been a partner at Wilmer Cutler Pickering Hale and Dorr LLP since July 2003. She has held numerous positions in the U.S. government, serving as Deputy Attorney General of the United States, General Counsel of the Department of Defense, Assistant to the Secretary of Energy, and a member of the bipartisan National Commission on Terrorist Threats Upon the United States. Ms. Gorelick has served as a director of Amazon.com, Inc. since February 2012 and currently serves as Chair of its Nominating and Corporate Governance Committee. She previously served as a director of United Technologies Corporation from February 2000 to December 2014 and a director of Schlumberger Limited from April 2002 to June 2010. She holds B.A. and J.D. degrees from Harvard University.

Qualifications

Ms. Gorelick is an experienced attorney with significant expertise in legal, policy and corporate matters. Ms. Gorelick’s regulatory and policy experience is directly relevant to the Company’s business. She is well-versed in critical infrastructure and national security issues and brings a valuable skill-set and wealth of government experience to the Board. Ms. Gorelick has served on several other corporate boards, a compensation committee and a nominating and corporate governance committee, and served on numerous government boards and commissions. Ms. Gorelick’s experience in both the public and private sectors, combined with her experience in the corporate boardroom, provides her valuable board experience, and she offers a perspective the Board values.

| | | | | | | | |

| | |

Roger H. MooreIND | |

Age: 79 | | Committees: Audit, Corporate Governance and Nominating, Cybersecurity (Chair) |

| | |

Background

Mr. Moore has served as a director since February 2002. From December 2007 to May 2009, he served as a consultant assisting our Company in the divestiture of its former Communications Services business. From June 2007 through November 2007, Mr. Moore served as interim Chief Executive Officer and President of Arbinet-thexchange, Inc., a provider of online trading services. He was President and Chief Executive Officer of Illuminet Holdings, Inc., a provider of nationwide network and database services, from December 1995 until December 2001 when it was acquired by our Company. Mr. Moore has served as a director of Consolidated Communications Holdings, Inc. since July 2005 and previously served as a director of Western Digital Corporation from June 2000 through November 2014. Mr. Moore holds a B.S. degree in General Science from Virginia Polytechnic Institute and State University.

Qualifications

Mr. Moore is a business executive with significant expertise in general management, sales, technology, cybersecurity, and strategic planning in the telecommunications industry. Mr. Moore’s expertise contributes operational knowledge of important inputs to the Company’s businesses and provides valuable experience in areas of business administration. Mr. Moore also has significant experience, both as a senior executive and as a board member, in joint venture and mergers and acquisition transactions, which is experience that is valuable to the Board. Mr. Moore has experience in military intelligence, including serving two years at the National Security Agency. Mr. Moore’s financial and accounting skills qualify him as an audit committee financial expert. Mr. Moore has also served on several other boards of directors, including service on the audit, compensation and corporate governance committees of certain of those boards, providing him with valuable board-level experience. In addition to the several years of business management experience mentioned above, Mr. Moore has international business experience from his time as President of Nortel Japan and as President of AT&T Canada.

Proposal 1—Election of Directors

| | | | | | | | |

| | |

Louis A. SimpsonIND | |

Age: 84 | | Committees: Compensation (Chair), Corporate Governance and Nominating |

| | |

Background

Mr. Simpson has served as a director since May 2005. Mr. Simpson has served as Chairman of Gulf Shore Private Capital, LLC since July 2019. Mr. Simpson previously served as Chairman of SQ Advisors, LLC, an investment firm, from January 2011 to June 2019. From May 1993 to December 2010, he served as President and Chief Executive Officer, Capital Operations, of GEICO Corporation, a passenger auto insurer. Mr. Simpson previously served as Vice Chairman of the Board of GEICO from 1985 to 1993. Mr. Simpson holds a B.A. degree from Ohio Wesleyan University and an M.A. degree in Economics from Princeton University.

Qualifications

Mr. Simpson is a business executive with significant expertise in insurance, finance and private investment. Mr. Simpson’s expertise contributes all around business acumen, skills in strategic planning and finance, along with knowledge important to mergers and acquisitions activity. Throughout his career, Mr. Simpson has served on the boards of directors of more than fifteen publicly-traded companies, providing him with extensive and valuable board-level experience. Mr. Simpson’s board-level experience also includes previous audit committee, finance committee, nominating and corporate governance committee and compensation committee experience on certain of those public company boards. Mr. Simpson is a recognized expert in corporate governance matters, having lectured and presented numerous times on corporate governance topics at seminars and continuing education courses. As indicated above, Mr. Simpson’s career includes executive-level experience as a chief executive officer, providing him with a perspective that the Board values.

| | | | | | | | |

| | |

Timothy TomlinsonIND | |

Age: 71 | | Committees: Audit (Chair), Compensation, Corporate Governance and Nominating, Cybersecurity |

| | |

Background

Mr. Tomlinson has served as a director from the Company’s founding in 1995 until 2002, and again since his reappointment in November 2007. From May 2011 through December 2013, Mr. Tomlinson was a corporate lawyer employed as General Counsel of Portola Minerals Company, a producer and seller of limestone products. From May 2007 through May 2011, Mr. Tomlinson was employed as Of Counsel by the law firm Greenberg Traurig, LLP. Mr. Tomlinson was the founder and a named partner of Tomlinson Zisko LLP and practiced with this Silicon Valley law firm from 1983 until its acquisition by Greenberg Traurig, LLP in May 2007. He served as managing partner of Tomlinson Zisko LLP for multiple terms. While at Tomlinson Zisko LLP, Mr. Tomlinson and his firm served as the licensing counsel to RSA Data Security, Inc. and the Company for a wide variety of cryptographic and related cybersecurity products. Mr. Tomlinson holds a B.A. degree in Economics, a Ph.D. degree in History, an M.B.A., and a J.D. degree from Stanford University.

Qualifications

Mr. Tomlinson has significant expertise in corporate matters including finance and mergers and acquisitions and has represented clients in the technology industry for more than thirty years. Mr. Tomlinson’s long-term service on our Board has provided him with valuable insight and institutional knowledge of the Company’s history and development. Mr. Tomlinson’s financial and accounting skills qualify him as an audit committee financial expert. He has extensive experience in corporate governance, both as a lawyer advising clients, and through serving on our Audit, Compensation and Corporate Governance and Nominating Committees, as well as the audit, compensation, and governance committees of other companies.

Corporate Governance

Overview

Our business is conducted by our employees, managers and officers, under the direction of our Chief Executive Officer and the oversight of the Board, to enhance the long-term value of our Company for our stockholders. Key corporate governance documents that guide our corporate governance structure and processes, including our Corporate Governance Principles and the charters of the Board’s committees, are available on our Investor Relations website at https://investor.verisign.com/corporate-governance.

Board Structure and Operations

Board Leadership Structure